Downloadable Case Studies

TCG Helps Medical Device Startup Save $130K in R&D Tax Credits

An Ohio-based medical device start-up company was unfamiliar with the R&D credit and had never claimed it before. Their CPA had contacted TCG to review the company’s operations, to determine if its activities would qualify for the R&D credit.

TCG learned that the company was created in 2019, and its focus is on developing ground breaking hardware and software technology, relating to cutting edge medical devices. In 2020, the devices were still under development, so the company had no sales but there was significant R&D expenses in employee wages and prototype materials.

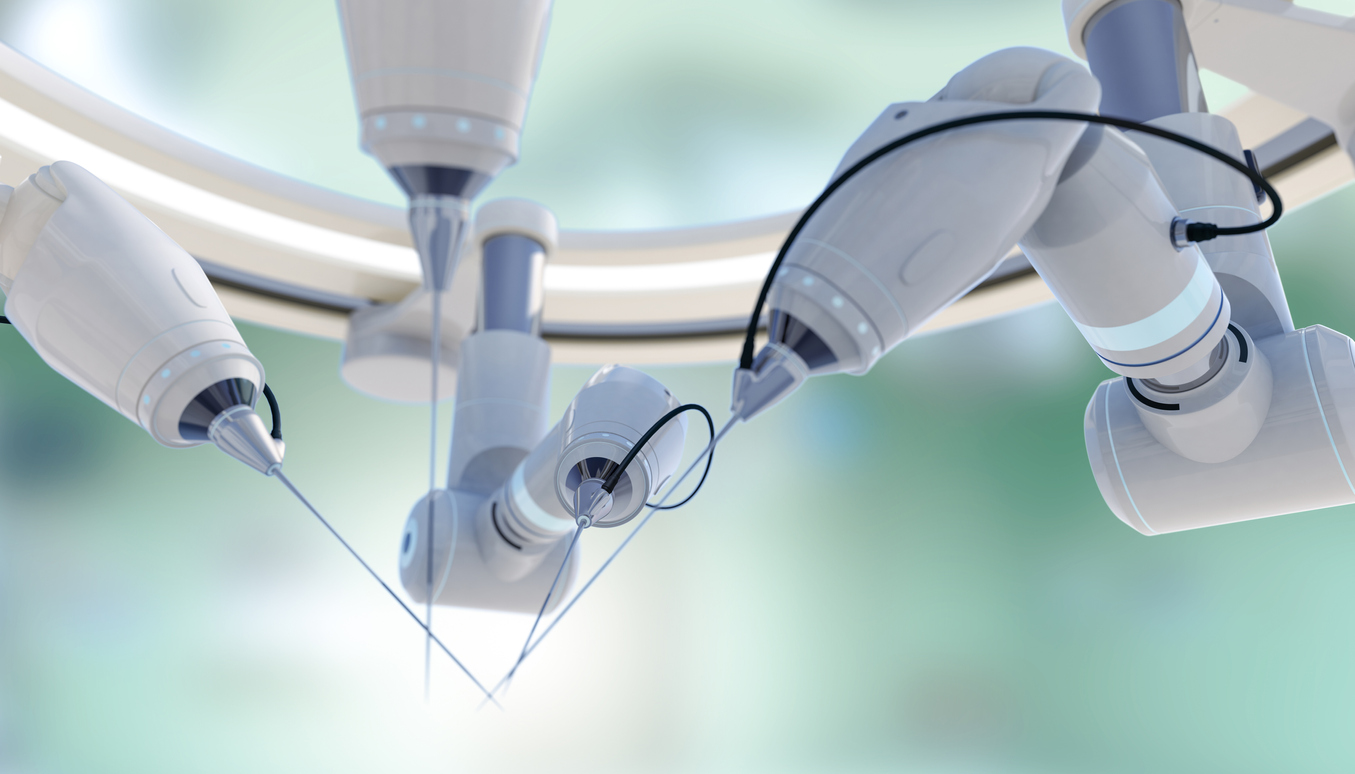

TCG Helps Robotic Cell Manufacturer Save $345K in R&D Tax Credits

Due to the COVID-19 Pandemic, factories and warehouses throughout the U.S. scrambled to create safe, social distant workspaces while simultaneously combatting massive staffing shortages, and many were struck with the realization that automation of their facilities would be the only way forward.

In direct response to this, an Ohio-based robotic cell manufacturer saw a unprecedented increase in demand for their custom automation and robotic cell services which forced them to quickly pivot from the manufacturing of their existing legacy products, to instead take on new opportunities including the creation of all-new mobile robots, new custom robotic cell projects, integrated robot arms for manufacturing processes and other engineered products. This resulted in a significant increase in engineering hours, prototype supplies, and the utilization of 3rd party contractors who contributed heavily to these engineering projects.

TCG Helps Software Developer Startup Save $60K in R&D Tax Credits

An Ohio-based mobile app developer was unfamiliar with the R&D credit and had never claimed it before. Their CPA had contacted TCG to review the company’s operations, to determine if its activities would qualify for the R&D credit.

TCG learned that the company was created in 2019, and its focus is on developing a ground breaking mobile app for the healthcare industry. In 2020, the software was still under development, so the company had no sales but there was significant R&D expenses in employee wages.

TCG Helps Architecture and Engineering Firm Secure $600K in R&D Tax Credits

A medium sized multidisciplinary design and engineering firm, with revenues of approximately $15 million, was engaged in a variety of different projects ranging from electrical power systems, instrumentation and controls, telecommunications, and distributed antenna systems.

Though the company had heard of the R&D tax credit, they were uncertain as to if the projects they were engaged in would qualify for it, and if so, what their estimated credit benefit might be. In addition, the company was concerned that the investment of internal resources needed to secure the credit might outweigh any benefits received.

TCG Helps Bank Secure Over $10 Million in R&D Tax Credits

A California bank had been investing heavily in software development projects that were intended to benefit both its customers, as well as its own internal business operations (“internal-use”).

The internal-use software development projects that were undertaken by the bank were intended to improve internal workflows and automation which would ultimately lead to improvements in speed and reductions in cost. Due to the unique operations of the bank, a commercially available software solution did not exist which could be purchased to accomplish the needs of the bank. Rather, for most projects, the only option the bank had was to develop these solutions from the ground-up. Substantial resources were committed to these projects, and there was no guarantee that the investment of these resources could be recouped within a reasonable timeframe.

The customer-interactive software development projects were undertaken by the bank for a variety of reasons. This included enhancements to a customer dashboard, the development of a mobile banking application, enhancements to security authentications, and necessary compliance updates that were needed due to ever-changing regulatory requirements.

TCG Helps an Ohio Injection Molder Save $200K and Reduce Audit Risk

An Ohio-based injection molding company reached out to Tax Credits Group (TCG) for a free R&D tax credit assessment and analysis. The company had been claiming the federal Research & Development tax credit for some time, but had concerns that they were not maximizing their credit—nor developing the kinds of procedures that would allow them to substantiate their credit claims should they be selected for audit by the IRS.

Beginning with a Free Credit Assessment, TCG was able to help the company to the tune of a $200K tax savings and a reduced audit risk.

Premium R&D Articles

Final Regulations Further Expand the R&D Tax Credit for Software Development

In this Spring 2017 Journal of Taxation article, Tax Credits Group President Michael Krajcer provides readers with an understanding of the final regulations issued on October 4, 2016, and how they have revised the proposed rules, making significant favorable changes and providing much greater clarity.

Armed with these regulations and a permanent credit, taxpayers conducting software development are now in a much better position to plan for and document research credit claims.

In this article, you will learn the following:

- Why Internal-Use Software (IUS) has historically been subject to more stringent eligibility requirements.

- What the ‘High Threshold of Innovation’ test is and why this eligibility requirement was so challenging for taxpayers developing IUS software to meet.

- How final IUS regulations now provide taxpayers with clarity as to the definition of the three requirements that make up the high-threshold–of-innovation test, and the process-of-experimentation test that all software development is subject to.

- How dual-function software will be addressed moving forward; (Both IUS and non-IUS software are being developed as part of an integrated system.)

- Why financial institutions developing customer-facing software are sure to benefit from these final regulations.

Recent Changes to the R&D Tax Credit Provide Improved Incentives for Businesses

In a Sept/Oct 2017 article written for the Ohio Society of CPAs (OSCPAs) CPA Voice magazine, Tax Credits Group President Michael Krajcer provides readers with an overview on these recent favorable changes which stem from new payroll and Alternative Minimum Tax (AMT) offsets, and the issuance of Final Regulations relating to Internal Use Software (IUS) development.

In this article, you will learn the following:

- Why small businesses that once found themselves in AMT and thus unable to benefit from the research credit now have new opportunity to alleviate this tax burden.

- How the new payroll tax offset provision allows cash-strapped startups to immediately benefit from tax savings in the years where they need it most.

- How new Treasury Regulations broaden the definition of IUS, making it easier for businesses investing in this area to claim the incentive.

- Why the Final IUS Regulations allow for the expanded utilization of this incentive and reduce the controversy that has historically plagued taxpayers who have claimed it.

Using Tax Credits To Encourage Innovation

In a March/April 2017 article written for the Virginia Society of CPAs (VSCPAs) Disclosures magazine, Tax Credits Group President Michael Krajcer provides readers with an overview on these recent favorable changes, and explains why they are particularly beneficial to innovative taxpayers located within the state of Virginia.

In this article, you will learn the following:

- The benefits of a permanent federal credit and how the new Alternative Minimum Tax (AMT) and Payroll tax offset provisions will benefit certain eligible small businesses.

- Why final regulations related to Internal Use Software (IUS) development will drastically benefit businesses investing in customer facing software development.

- How new and improved Virginia legislation will provide enormous new opportunity for businesses conducting R&D within the state.

Encouraging Innovation: New Federal and Virginia Opportunities with R&D Tax Credits

In a May 2016 Virginia Society of CPAs (VSCPAs) article, Tax Credits Group President Michael Krajcer provides readers with an understanding of the R&D Tax Credit, why many businesses are often unaware of the incentive, and why recent changes to both the federal and Virginia statutes will allow significantly more taxpayers within the state to utilize incentives in far greater amounts.

In this article, you will learn the following:

- A brief history of the federal credit

- Why many businesses are overlooking the opportunity

- Why new legislation has expanded the applicability and incentive opportunity to taxpayers

- Why Virginia’s refundable state credit is one of the most progressive/favorable state credits in the country

- Why many businesses within the state of Virginia are failing to take advantage of this incentive

Taxpayer-Favorable Regulations Expand the R&D Tax Credit for Customer-Facing Software Development

In this 2015 Journal of Taxation article, Tax Credits Group President Michael Krajcer provides readers with an understanding of why financial institutions in particular will benefit from these new rules, which focus on software that enables third-party interaction with businesses.

In this article, you will learn the following:

- Legislative history on Internal-Use Software as it relates to the R&D Tax Credit

- How the 2015 proposed regulations help to clarify the definition of Internal Use Software and Non-Internal Use Software

- Why financial institutions investing in technologies such as online banking, online investment services, web-based insurance quoting services, and mobile apps stand to benefit most from the new regulations

Favorable Ruling in FedEx Case Provides Opportunity for Financial Institutions Developing Internal-Use Software to Claim the Research Tax Credit

In 2009, The U.S. District Court for the Western District of Tennessee held that the Internal Revenue Service could not require FedEx to apply the so-called “discovery” test in order to claim the research credit for its development of internal-use software.

In a historical look-back at this landmark case, Tax Credits Group President Michael Krajcer provides readers with the following:

- A regulatory overview of IUS qualification hurdles

- Detail on the additional 3-Part Test requirements for IUS development

- An explanation on how elimination of the “Discovery test” played a vital role on the court’s final ruling

- Practical implications and interpretations stemming from the ruling

Recent Extension and Modification of the Research Credit Provides New Opportunities for Financial Institutions

In 2007, Tax Credits Group President Michael Krajcer authored an article for the Journal of Taxation detailing the changing, favorable landscape of the Research & Development tax credit, specifically as it related to financial institutions.

In this historical look-back, readers will learn the following:

- Why the Research & Development tax credit became an attractive opportunity for Financial Institutions

- What legislative updates were impacting the credit back in the mid 2000’s

- What credit methodologies were in place